Applying for Importer Exporter Code Renewal (IEC)

Your enquiry has been posted, we will get back soon!

Below, we discuss about the Importer Exporter Code renewal

If you have an IEC certificate, you will be required to renew the IEC every year during the April-June period. Failing to do so will result in the deactivation of your IEC license.

Applying for renewal of an Importer Exporter code through the Chartered ONE portal is beneficial for you as we do it for free, you just have to pay the government fee which is Rs. 200. This will help you to focus on your business without worrying about renewal follow-ups, we will handle all that for you. We have been in this business for quite a long time and we know what all you require for smooth import-export transactions. We will also keep you updated about the RCMC requirement and apply on your behalf upon your request. Our goal is to ensure your success and become your trusted partner in achieving it.

Importer Exporter Code (IEC) is a ten-digit unique code that will be assigned to you or your company by the Director General of Foreign Trade (DGFT) and is a mandatory requirement if you want to engage in any kind of import or export of goods in India regardless of the value of the trade.

The IEC is unique to each business entity and once you have obtained an IEC for your business it is valid for a lifetime and is non-transferable

You will also need to renew the Importer Exporter Code every year, it is mandatory now for IEC License holders. Once the import export code is issued, you can apply for port registration on the ICEGATE portal with the help of AD Code registration.

However, IEC is not necessary to be obtained if you are engaged in the export of services except when you as a service provider are taking benefits under the Foreign Trade Policy.

Under the 12th February, 58th Notification by DGFT, certain amendment clauses were introduced for the Importer and Exporter Code (IEC):

It is worth noting that this deactivation does not affect any other actions taken for violating other Foreign Trade Policy (FTP) provisions

You do not need to worry about the registration process, we will do it for you for Free

However, if you want to do it yourself, Here are the steps that can help:

Step 1: Login using your credentials. Click on Link IEC. Once you have linked your IEC, a new pop-up window opens asking for digital signature requests. For this, you are required to authenticate either by Digital Signature Certificate or Aadhar-based OTP.

Step 2: Once you have been linked by authentication, you can renew or update other information on your IEC. Choose the "Update/Modify IEC" option.

Step 3: In the pre-filled application form, if there are any changes in your business details then you can make such changes

However, the PAN details, nature of the concern, and GSTN are permanent for an IEC and cannot be changed.

The following details can be modified:

Step 4: Give your declaration, check the application summary and click on the sign button to sign the application using your DSC or Aadhaar-based OTP.

Step 5: Once approved and renewed, you will receive the IEC certificate in the email and you can download and print the IEC from the DGFT website.

The main purpose of the IEC is to track and monitor your imports and exports and to ensure that they comply with the country's foreign trade policy.

An IEC is mandatory if you wish to import or export goods in India, and is required to be quoted in all shipping documents.

Here are some examples:

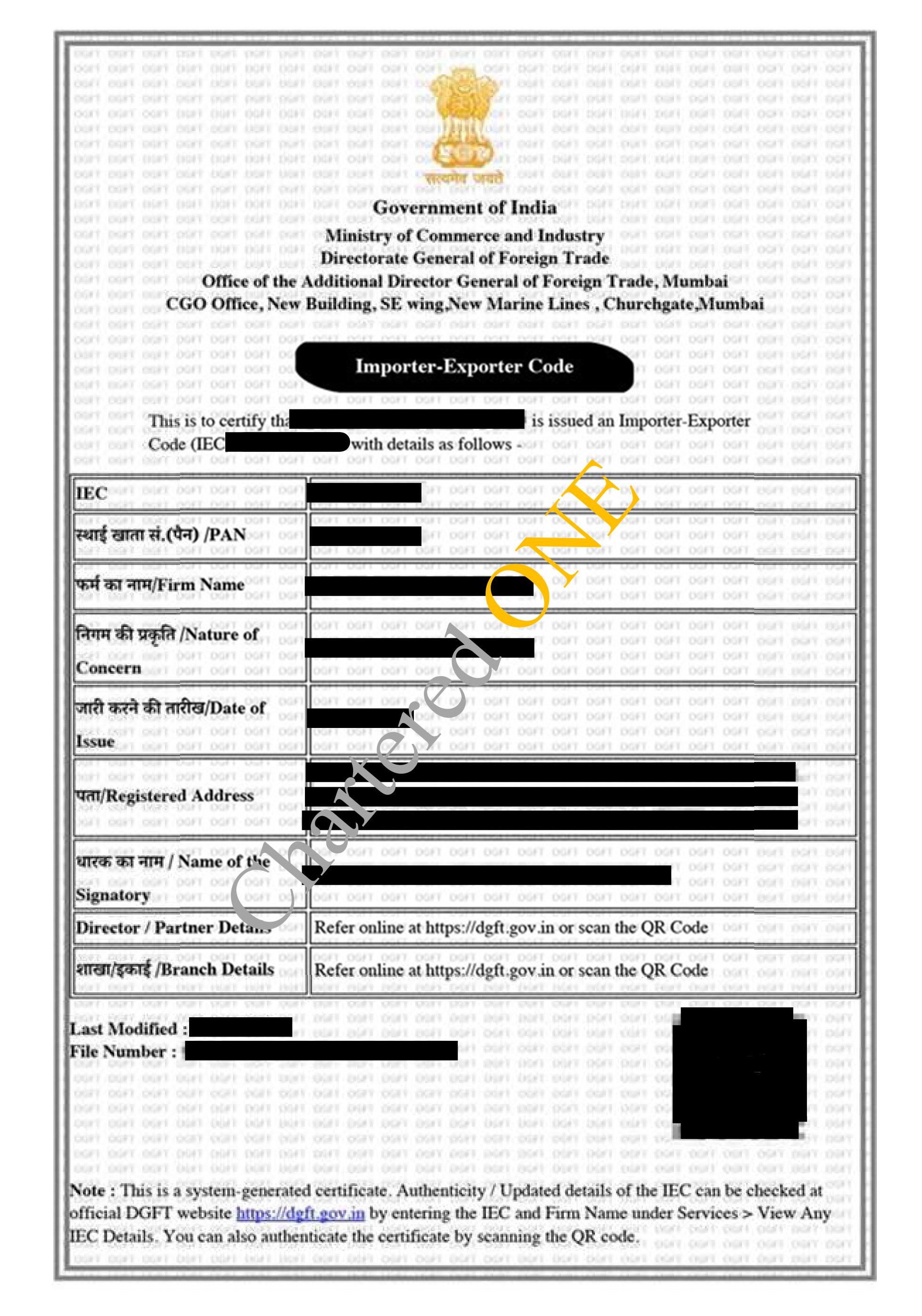

Here is the updated IEC certificate you will receive upon successful renewal.

IEC renewal is a mandatory annual process for businesses engaged in import and export activities in India. It ensures that the exporter's information remains updated with the Directorate General of Foreign Trade (DGFT) and maintains the IEC's active status. Timely renewal prevents the deactivation of importer exporter code, which can restrict your export operations.

Here are some common questions we receive from our customers. If you have any additional questions, please don’t hesitate to contact us.

You will have to renew your IEC certificate annually between April and May to ensure your export business runs smoothly.

Over 10,000 businesses have trusted us to handle their registration and compliance needs, ensuring they operate smoothly and in accordance with Indian laws and regulations. For over six years, we’ve been committed to making the process of starting and managing a business straightforward and transparent. Your trust is our top priority.

Our platform is built and maintained by a team of Chartered Accountants and compliance experts, combining the latest technology with our extensive knowledge of Indian business regulations. Every day, we help businesses register, file taxes, and maintain compliance with local and national laws.

We understand the frustration of dealing with legal paperwork and complex regulatory requirements, and we’re dedicated to providing accurate and reliable services. We ensure your business stays compliant with the latest laws, so you can focus on growing your business. We are fully transparent about our services and fees, making sure you know exactly how we help and what you’re paying for.

We put significant effort into keeping our platform updated with the latest regulations. Our team regularly reviews and verifies compliance updates, and we rely on feedback from clients like you to continuously improve our services.

If you notice anything that isn’t right, you can report the issue to us, and we’ll address it promptly.

Get expert guidance on business setup, compliance, and international expansion. Contact us today to take your business to the next level.

+91 63003 47380, +91 87900 59682